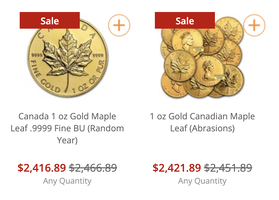

I know this group likely knows this but for anyone not paying attention - Costo has the best deals on Gold and silver at the moment. With an executive membership and Costo Anywhere Visa you're getting 4% cash back. (You might do better on ebay with certain credit cards but more risk) Gold Eagles and Buffalos can be had at Below spot. Silver Maples at $1-2 over. You can pick up some Eagles right now at $3.02 over. Thats an insanely low premium for Eagles

The hard part is knowing when things are in stock as they sell out quickly. If you go to Louies' Website (

Best Silver gold Deals) where he searches every morning for the best deals, you can sign up for his email alert - The only thing he emails to you is when things are in stock at Costco